Nvidia Earnings Signal Ongoing AI Growth, Quell Bubble Fears

Nvidia’s latest financial results have reassured Wall Street that the artificial intelligence sector remains robust and is not at risk of peaking soon. The chipmaker reported third-quarter revenue of $57 billion, beating analysts’ projections of $55 billion. Nvidia’s data center branch also outperformed expectations, generating $51 billion compared to the anticipated $49.31 billion. Earnings per share came in at $1.30, ahead of the estimated $1.26. Looking forward, Nvidia forecasts fourth-quarter revenue of $65 billion, surpassing the consensus estimate of $61.98 billion.

By the numbers

- Q3 revenue: $57B (vs. $55B est.)

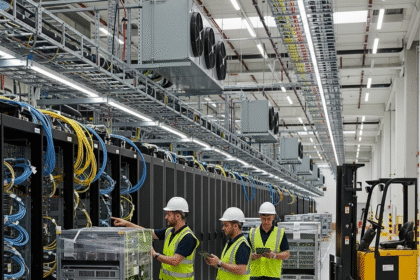

- Data center revenue: $51B (vs. $49.31B est.)

- EPS: $1.30 (vs. $1.26 est.)

- Q4 revenue guidance: $65B (vs. $61.98B consensus)

Market reaction and investor sentiment

The strong results triggered a jump in Nvidia’s stock, climbing over 4.5% in after-hours trading as investors reacted to the company’s optimistic outlook and robust performance. Dan Ives from Wedbush Securities described the quarter as a landmark moment for technology investors, emphasizing that concerns about an AI bubble are exaggerated. Other market observers agreed, noting that both product demand and supply chain development demonstrate the sector is still in early growth stages. Despite industry apprehensions about mounting capital expenses among leading cloud providers, the numbers suggested continued investment and expansion.

Pipeline strength: Blackwell and Rubin momentum

Nvidia’s leadership pointed out that the company has orders for its Blackwell and Rubin AI chips totaling over $500 billion through 2026, with expectations that this figure will increase as new customers, such as Anthropic, join the roster. The company highlighted that its Blackwell GPU sales are particularly robust, and cloud computing partners have fully utilized their available inventory. Jefferies analysts noted that shipments of Nvidia’s Blackwell GB300 chip drove impressive results and should reassure investors in AI-focused stocks.

AI bubble debate

While discussions about an AI bubble have surfaced, Nvidia CEO Jensen Huang refuted this idea, stating that the company plays a pivotal role through all stages of AI development. Industry leaders are divided on the topic—Microsoft cofounder Bill Gates recently cautioned that the sector could be experiencing a speculative surge, while former Google CEO Eric Schmidt suggested the current excitement represents a new wave of industrial transformation rather than a financial bubble.

Key takeaway

Revenue beats, accelerating guidance, and multi-year chip orders point to durable AI demand—not a peak.

Bottom line

Overall, Nvidia’s blockbuster quarter has reinforced the market’s confidence in the ongoing strength and growth prospects of the AI industry, calming fears and reaffirming investor optimism.