Nvidia and Intel’s $5B AI chip partnership

Nvidia will invest $5B in Intel to co-design AI chips for data centers and PCs, integrating x86 CPUs with Nvidia GPUs. The pact pressures AMD and may draw scrutiny.

Inside the partnership

Nvidia and Intel have struck a $5 billion deal that pairs fresh investment with deep technical collaboration, signalling a tighter alignment between two longtime rivals as AI computing reshapes data centers and PCs.

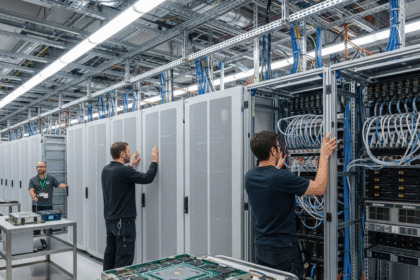

Under the agreement, Nvidia will invest $5 billion in Intel and the companies will co-design custom products for servers and personal computers. Intel will build tailored x86 CPUs designed to work closely with Nvidia’s AI GPUs and NVLink interconnect. The partners also plan a system-on-a-chip that combines an Intel CPU with an Nvidia GPU on a single package, an approach aimed at boosting performance and energy efficiency for AI-heavy workloads.

“The actual workloads market is going to shift dramatically to inference-based systems and smaller edge-based systems,” said Jack Gold, analyst and president at J. Gold Associates.

Why now: inference and the edge

Industry analysts say the timing reflects a shift from massive training clusters to inference and smaller, edge-focused systems, a trend pushing tighter CPU–GPU integration. Closer coupling can reduce latency and improve throughput for AI tasks, especially where CPU-side pre-processing and data orchestration are critical.

The market shift could drive new cooperation between Nvidia and Intel. It also gives Nvidia access to customers it lacked before, such as in the PC market. They have long shown a desire to gain a foothold in this market with its GPUs,” said Gaurav Gupta, an analyst at Gartner. “That’s a big opportunity.”

Gold noted another opportunity for Nvidia lies in Intel’s CPU market share, which remains strong even though Intel trails Nvidia in GPUs.

Nvidia needs to have connectivity into CPUs where a lot of pre-processing for AI happens, and so having that relationship is a big deal,” he said.

The deal also brings Intel fresh capital and a chance to regain market share. But the 57-year-old company is under pressure. It announced plans in July to cut 25,000 jobs and reported a $18.8 billion loss in 2024. Intel has been struggling with its legacy, like the x86 architecture, which had been dominant for years, and they have been using market share,” Gupta said.

Nvidia is not the only investor in Intel. Last month, the U.S. government took a 9.9% stake, becoming Intel’s largest investor. The Nvidia-Intel partnership also poses risks for AMD.

“AMD is doing some good stuff,” Gold said. “They have good CPUs and GPUs, but now they have two big players getting together. Ultimately, it can’t help them.”

How does the partnership profit NVIDIA and Intel?

What Nvidia gains

Beyond the data center, the tie-up opens a more direct path for Nvidia into PC designs, an area where it has long sought broader influence. Closer integration with Intel’s dominant CPU lineup could help Nvidia embed its AI accelerators deeper into mainstream systems and expand its software ecosystem across more endpoints.

What Intel gains

For Intel, the deal brings capital and a chance to reassert itself in higher-growth AI segments. The 57-year-old chipmaker has faced financial strain—reporting a $18.8 billion loss in 2024—and in July said it plans to cut about 25,000 jobs by year-end. The partnership offers a route to win back share through custom silicon while leveraging Nvidia’s momentum in AI accelerators. Adding to the complex backdrop, the U.S. government last month acquired a 9.9% stake in Intel, becoming its largest investor.

Competitive pressure on AMD

The alliance heightens pressure on AMD, which competes with both companies in CPUs and GPUs. Although AMD has strengthened its AI portfolio, a combined Nvidia–Intel push could make design wins more challenging, particularly in enterprise data centers and OEM PCs where Intel has longstanding relationships.

Motivations and scrutiny

The deal arrives as Nvidia faces restrictions on selling some advanced AI chips to China, a constraint that could be mitigated by diversified product pathways and partnerships. Meanwhile, Nvidia’s rapid spending and deal-making have customers and competitors watching closely. Some industry observers warn that growing influence over AI infrastructure choices could limit buyer flexibility and draw regulatory attention, especially as policymakers scrutinize concentration across the tech supply chain.

What to watch next

- Product roadmaps: Details on the co-developed SoC, memory architectures, and NVLink integration will show how far and how fast the stack can be unified.

- OEM adoption: Wins in tier-one servers and PC platforms will indicate whether the partnership translates into volume deployments.

- Regulatory reaction: Scrutiny of market power and customer choice could shape how aggressively the companies scale joint offerings.

The bottom line

The $5 billion partnership marries Nvidia’s leadership in AI acceleration with Intel’s CPU scale and manufacturing reach. If successful, it could redefine standard system designs for AI across data centers and PCs—while intensifying competition and inviting closer oversight from regulators.