Nvidia’s Record Earnings Impress Despite Wall Street Skepticism

Nvidia’s Record Earnings Win Over Skeptics

Earnings at a Glance

Nvidia, now the world’s most valuable company, reported outstanding third-quarter earnings, with revenue soaring 62% compared to the previous year. Even Wall Street’s only analyst with a sell rating on Nvidia, Jay Goldberg of Seaport Research Partners, acknowledged the company’s strong performance.

“It was a good quarter, I give them full credit for that.”

— Jay Goldberg, Seaport Research Partners

While Goldberg noted that Nvidia’s guidance was solid rather than exceptional, it still exceeded expectations. He remains cautious about lingering challenges facing the tech sector.

Guidance and Soaring Demand

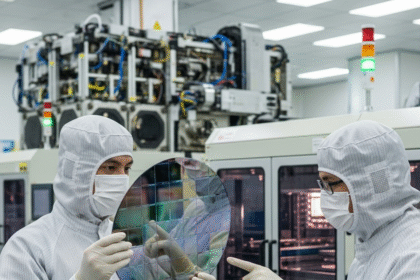

On the earnings call, CFO Colette Kress projected that Nvidia’s Blackwell and Rubin chips could generate a staggering $500 billion in revenue by 2026. CEO Jensen Huang highlighted overwhelming demand across cloud providers.

“Blackwell sales are off the charts, and cloud GPUs are sold out.”

— Jensen Huang, Nvidia CEO

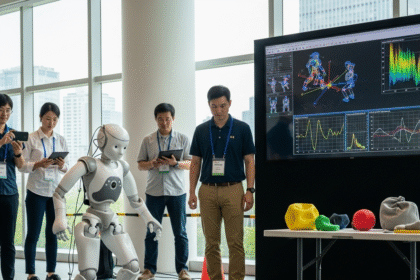

AI Bubble Debate and Market Weight

Nvidia’s dominance sits at the center of the ongoing debate about a potential AI investment bubble. The company now represents 8% of the S&P 500 and 1% of the global market. Addressing bubble concerns, Huang argued that customers are already seeing tangible returns from AI investments by companies such as Meta and OpenAI.

“From our vantage point, we see something very different.”

— Jensen Huang, on AI bubble concerns

Skeptics Hold Their Ground

Despite the impressive results, Goldberg maintains his sell rating, questioning whether customers can continue spending so heavily on Nvidia’s chips—particularly emerging “neocloud” companies, whose long-term demand remains uncertain.

“The sort of growing looming question is how long can they keep this up?”

— Jay Goldberg

Market Impact: What to Watch

Industry watchers are closely monitoring whether Nvidia’s performance will bolster the wider stock market. Dan Morgan of Synovus Trust noted that challenges facing Nvidia and the broader AI sector remain unresolved, even in light of these record results.

Note: Quotes and figures reflect statements from Nvidia’s latest earnings call and commentary from market analysts referenced in the report.