Nvidia’s AI Boom: CEO Optimistic, Experts Warn of Risks

Nvidia’s AI Surge Faces Optimism and Skepticism

Nvidia CEO Jensen Huang insists the world is witnessing an artificial intelligence revolution, not a speculative bubble—a claim that divides investors as the company posts record profits amid persistent market doubts.

Earnings Surge and “Tipping Point” Claims

Nvidia’s recent earnings report surpassed forecasts, driving its market valuation above $4.5 trillion. Huang asserts that Nvidia’s computing technology is becoming essential across industries, powering everything from software development to advanced robotics. He sees this as a “tipping point” for AI’s role in daily life.

“The world is witnessing an AI revolution, not a speculative bubble.”

— Jensen Huang, Nvidia CEO

By the Numbers

- Market value: $4.5T+

- Quarterly revenue: $57B

- 61% of revenue from four customers

- Long-term capacity contracts: $26B

Customer Concentration and Profit Risks

Much of Nvidia’s explosive growth, however, comes from just four major customers, as revealed in regulatory filings. In the latest quarter, 61% of Nvidia’s $57 billion revenue stemmed from these clients, believed to include tech giants such as Microsoft and Meta. This degree of customer concentration raises risks, especially as many AI ventures and startups behind the spending remain unprofitable.

Circular Deals and Massive AI Investments

Furthermore, Nvidia has dramatically increased spending on renting its own chips back from these cloud providers, locking in $26 billion—up from $12.6 billion last quarter—in long-term contracts running through at least 2031. The company is also making hefty investments in leading AI labs, including up to $100 billion for OpenAI and $10 billion for Anthropic, among its major clients.

This circularity—where Nvidia sells to cloud builders, rents capacity from them, and invests in their operations—concerns some analysts. Chaim Siegel, of Elazar Advisors, warns that much of the boom relies on loss-making companies and projects, risking a sharp downturn if spending pulls back before profits materialize.

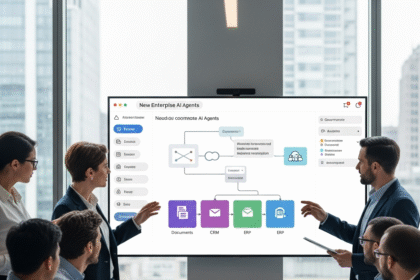

Huang’s Thesis: Three Market Transitions

Still, Huang dismisses talk of a bubble, emphasizing three transitions in the market that he believes will drive durable demand for AI infrastructure and cement Nvidia’s position:

- Software migration: The shift of traditional software to Nvidia’s architecture.

- New AI applications: The rise of tools like coding assistants.

- From virtual to physical: Expanding AI into autonomous vehicles and robotics.

Infrastructure Constraints

Yet even supporters express reservations. Building data centers for this AI future will require vast resources—land, electricity, and financing—challenges Nvidia claims to be addressing through strategic partnerships.

Rising Competition

Competition is also intensifying, with companies like Alphabet (Google’s parent) and Amazon designing and offering their own AI chips. Some analysts, including Jay Goldberg at Seaport Research Partners, doubt Nvidia’s ability to maintain its commanding lead, warning that potential setbacks outweigh the upside surprises.

Bottom Line

In summary, Nvidia stands at the forefront of an AI transformation, according to its CEO. However, questions over profit sustainability, customer dependency, industry competition, and infrastructure needs continue to divide investors over whether the moment marks a true inflection point or signals a looming correction.