Wall Street Rallies on AI Boom, Rate Cut Expectations

Wall Street Surges on Strong AI Earnings and Rate Cut Optimism

Market Snapshot

- S&P 500: +1.7%

- Dow Jones Industrial Average: +581 points (+1.3%)

- Nasdaq Composite: +2.2%

- Nvidia: +3.9% after earnings beat and upbeat guidance

- Palantir Technologies: +5.1%; Oracle: +2.8%

- Walmart: +3.3% on stronger results and raised outlook

- 10-year Treasury yield: 4.13% → 4.10%

- Japan’s Nikkei 225: +2.6%; South Korea’s Kospi: +1.9%

Market Overview

Wall Street experienced robust gains Thursday as optimism around artificial intelligence and potential interest rate cuts fueled investor enthusiasm. The S&P 500 jumped 1.7%, nearing its previous all-time high set nearly a month ago. Meanwhile, the Dow Jones Industrial Average climbed 581 points (1.3%), and the Nasdaq Composite rose 2.2%, reflecting broad market strength.

AI Earnings Lead the Rally

Nvidia led the rally, surging 3.9% following a quarterly earnings report that exceeded analyst predictions. The company also delivered an upbeat revenue forecast, helping soothe concerns that major AI-linked stocks might be overvalued—an anxiety reminiscent of the early 2000s dot-com boom. By posting continuing strong profits and projecting further growth, Nvidia and its AI sector peers offered justification for the dramatic recent run-ups in their share prices.

Other technology companies tied to artificial intelligence also saw significant advances. Palantir Technologies was up 5.1%, while Oracle gained 2.8% in the wake of Nvidia’s results.

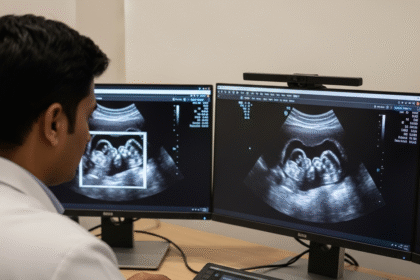

Labor Market Resilience and Fed Outlook

The rally was further supported by economic data suggesting continued strength in the U.S. labor market. A delayed September jobs report indicated that hiring was stronger than anticipated, although the unemployment rate ticked up slightly. According to Seema Shah, chief global strategist at Principal Asset Management, the data suggests economic resilience while also offering possible justification for the Federal Reserve to consider an interest rate cut at its December meeting. Trader expectations for a rate reduction rose to 42%, up from 30% the day before.

Interest rate policy remains a major driver for stock prices, with hopes for further cuts providing stimulus for equities. Lower rates tend to boost investment and economic growth but can also threaten higher inflation, which remains above the Federal Reserve’s 2% goal.

Beyond Tech: Retail Strength

Walmart shares advanced 3.3% after the retail giant reported stronger-than-expected quarterly results and raised its financial outlook for the rest of the year. The company has attracted value-conscious shoppers amid ongoing economic worries, positioning itself for a robust holiday season.

Bonds and Global Markets

Bond markets also responded, with the yield on the 10-year Treasury note slipping from 4.13% to 4.10%. Overseas, equity markets rallied in Europe and Asia, highlighted by Japan’s Nikkei 225 rising 2.6% and South Korea’s Kospi up 1.9%.

Outlook

The day’s market surge demonstrates continued investor confidence in technology and hopes for supportive monetary policy as 2025 unfolds.